Overview

Iraq’s Fast-Moving Consumer Goods (FMCG) sector is riddled with challenges, but it also presents significant opportunities for growth, particularly for companies looking to enter the market and establish efficient distribution strategies. The post-conflict economy, reliance on imports, and underdeveloped infrastructure make navigating the Iraqi market complex. However, these challenges create opportunities for companies willing to invest in tailored market entry and distribution approaches. This article explores the FMCG market challenges in Iraq and highlights opportunities for growth.

Navigating Market Entry Challenges

One of the key FMCG market challenges in Iraq is navigating the difficult entry barriers. Iraq’s political instability and inconsistent regulatory frameworks create an unpredictable environment for new businesses. Bureaucratic red tape, unclear customs procedures, and a lack of legal protections for investors complicate the entry process for FMCG companies. Furthermore, local manufacturing remains underdeveloped, leading to a heavy reliance on imports to meet the growing consumer demand.

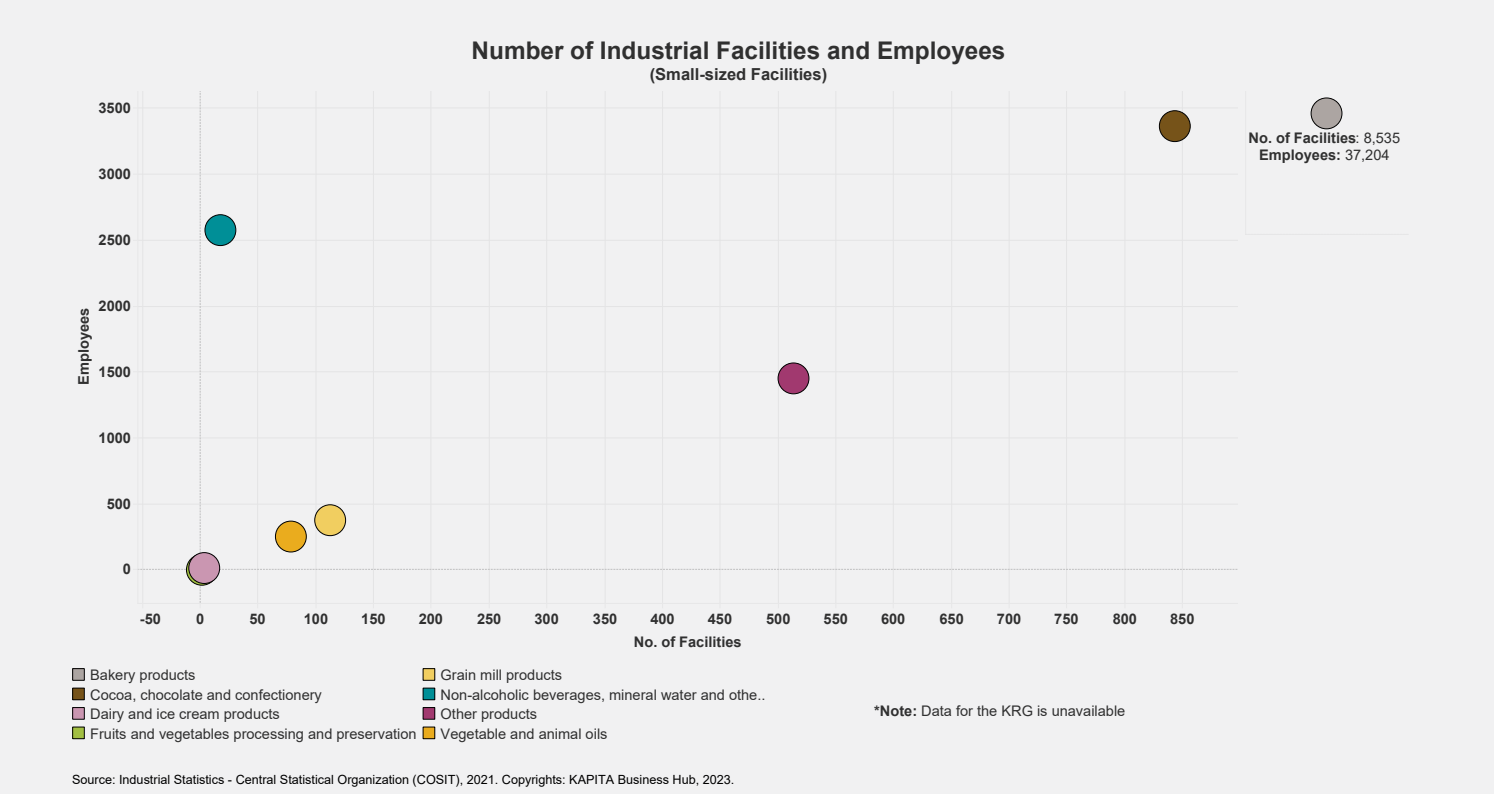

In 2020, Iraq had a total of 10,495 food and beverage manufacturing establishments, with the Kurdistan Region of Iraq (KRG) accounting for an additional 117 establishments. Despite this, local production is insufficient to meet the country’s demand, particularly in high-demand sectors like bakery and grain mill products. Companies that can navigate these entry barriers stand to gain access to a market of over 40 million consumers with increasing purchasing power. Tailoring products to local preferences and understanding the cultural and logistical nuances of the market are critical for successful market entry.

Distribution Challenges and Opportunities

Distribution represents another significant FMCG market challenge in Iraq. The country’s infrastructure, particularly in terms of logistics and transportation, is underdeveloped. Road networks, warehouses, and cold storage facilities remain limited, particularly outside major urban centers like Baghdad, Basra, and Erbil. As a result, FMCG companies often face high costs and delays in getting their products to market, especially in rural areas.

However, these distribution challenges present an opportunity for companies that are willing to invest in logistics solutions. Hypermarkets and retail chains have grown in popularity in Iraq, and there is an increasing demand for streamlined supply chains that can service these outlets efficiently. Companies that can develop or partner with local distribution networks will have a competitive edge in bringing their products to market more quickly and cost-effectively.

Leveraging Technology for Growth

One of the more exciting opportunities in Iraq’s FMCG market is the rise of technology-based solutions for distribution and market expansion. Iraqi-based startups and SMEs are increasingly incorporating e-commerce platforms and online tools to reach consumers more effectively. This digital transformation offers FMCG companies the opportunity to bypass some of the traditional logistical barriers by leveraging online retail channels. With the increasing internet penetration and the growing adoption of smartphones, e-commerce platforms offer a promising route for growth, especially for companies that want to reach younger consumers.

Incorporating technology into market entry and distribution strategies is a forward-thinking way to overcome the country’s infrastructure challenges. Moreover, aligning with local technology initiatives, such as last-mile delivery services and digital payment systems, can create more seamless operations for FMCG brands.

Opportunities in Local Partnerships and Manufacturing

While Iraq remains heavily reliant on imports, there is untapped potential in local manufacturing. Companies entering the FMCG market can consider strategic partnerships with local producers, which can help overcome the reliance on international imports. Establishing local manufacturing plants, especially in high-demand sectors like food and beverages, could lead to long-term cost savings and provide a unique competitive advantage.

For example, Iraq’s food and beverage sector ranked first in terms of the number of small and medium-sized production establishments in 2020. In total, there were 8,535 bakery establishments, making it one of the most dominant industries. By aligning with these local producers or setting up their own operations, companies can tap into a growing market while also addressing the country’s need for locally produced goods.

Additionally, Iraq’s government is working to encourage local production by passing laws like the Consumer Protection Act and the Products Protection Act, designed to help domestic industries compete with international players. Companies that align with these initiatives by supporting local producers or setting up local manufacturing facilities stand to benefit as the market gradually shifts toward more self-reliant production.

Conclusion

The FMCG market challenges in Iraq are significant, from political instability and infrastructure issues to complex distribution networks. However, these challenges also provide growth opportunities for companies that can navigate the market strategically. By investing in logistics, leveraging technology, and forming local partnerships, FMCG companies can overcome entry and distribution barriers and tap into Iraq’s growing consumer base. With the right strategies, the Iraqi FMCG market offers substantial potential for growth and expansion.